Barclays Bank SWIFT Code Key for Crossborder Transfers

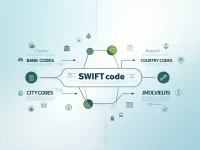

This article provides an in-depth analysis of the SWIFT code BUKBGB22SEC for BARCLAYS BANK UK PLC and its significance in cross-border remittances. It highlights the importance of code accuracy, processing times, and the necessity for professional consultation to enhance the efficiency of your international financial transactions.